The outlook for the oil industry in 2025

World Economy

The global economy maintained a stable growth trajectory, supported by healthy 1Q25 growth and tentative progress in US trade negotiations. The global economic growth forecasts remain unchanged at 2.9% for 2025 and 3.1% for 2026. The US economic growth forecasts remain at 1.7% for 2025 and 2.1% for 2026. Japan’s economic forecasts remain at 1.0% for 2025 and 0.9% for 2026. Eurozone economic growth forecasts remain at 1.0% for 2025 and 1.1% for 2026. China’s economic growth forecasts remain at 4.6% for 2025 and 4.5% for 2026. Following strong growth in 1Q25, India’s economic growth forecast for 2025 is revised up slightly to 6.5%, the same level as anticipated for 2026. Brazil’s economic growth forecasts remain at 2.3% for 2025 and 2.5% for 2026. Russia’s 2025 economic growth forecast is revised down slightly to 1.8%, but remains unchanged at 1.5% for 2026.

World Oil Demand

The global oil demand growth forecast for 2025 remains at 1.3 mb/d, year-on-year (y-o-y), unchanged from last month’s assessment. Some minor adjustments were made mainly to actual data for 1Q25. In the OECD, oil demand is forecast to grow by about 0.2 mb/d in 2025, while non-OECD demand is forecast to grow by more than 1.1 mb/d in 2025. In 2026, global oil demand is forecast to grow by 1.3 mb/d y-o-y, also unchanged from last month’s assessments, with the OECD forecast to grow by around 0.1 mb/d, y-o-y, while the non-OECD is forecast to grow by 1.2 mb/d, y-o-y.

World Oil Supply

Non-DoC liquids supply (i.e., liquids supply from countries not participating in the Declaration of Cooperation) is forecast to grow by about 0.8 mb/d, y-o-y, in 2025, unchanged from last month’s assessment. The main growth drivers are expected to be the US, Brazil, Canada, and Argentina. The non-DoC liquids supply growth forecast for 2026 is revised slightly down to 0.7 mb/d, with US, Brazil, Canada, and Argentina as the main growth drivers. Meanwhile, natural gas liquids (NGLs) and non-conventional liquids from countries participating in the DoC are forecast to grow by 0.1 mb/d, y-o-y, in 2025, averaging 8.4 mb/d, followed by a similar increase of about 0.1 mb/d, y-o-y, in 2026, to average 8.5 mb/d. Crude oil production by countries participating in the DoC increased by 180 tb/d in May, m-o-m, to average about 41.23 mb/d, according to available secondary sources.

The Shipbuilding Market size is estimated at USD 145.67 billion in the current year. It is expected to reach USD 184.50 billion over five years, registering a CAGR of 4.84% during the forecast period.

Over the long term, the shipbuilding market is expected to grow over the forecast period due to increasing seaborne trade and economic growth, rising energy consumption, the demand for eco-friendly ships and shipping services, and the advent of robotics in shipbuilding.

Though the shipbuilding market is facing a tough time, the major markets are still working and trying to turn the market toward a growth direction. In Korea, the government is taking various initiatives to support the shipbuilding industry, as the companies in the nation receive a greater number of orders.

Upstream, the international oil and gas newspaper, explores some of the crucial asset testing and hazard awareness training undertaken at Noble Offshore’s high-security Test Site.

The facility also plays host to hundreds of oil company staff every year, who undertake hazard awareness training courses that enable them to understand and control hazards, and reduce their safety and business risks.

A feature in Upstream, the international oil and gas newspaper, highlights what goes on at the site and asks one of Noble Offshore’s key clients why hazard awareness training is so important to their business.

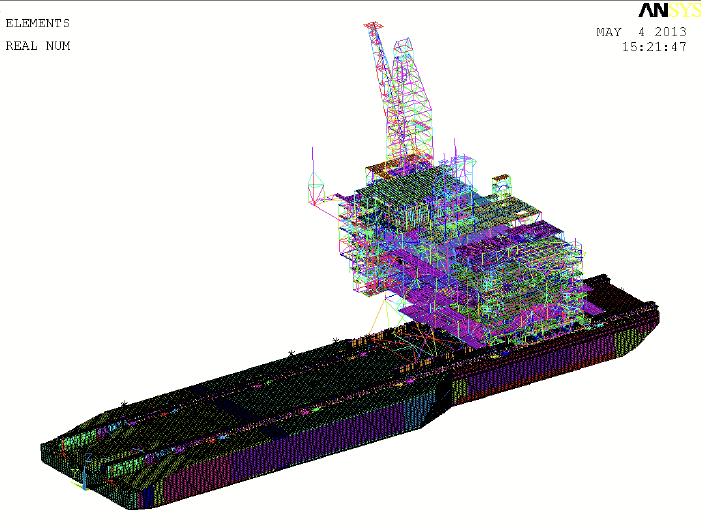

Oil and gas production is one of the world’s most exciting and demanding industries. It continuously faces huge technical, environmental and financial challenges. It operates in both the harshest and most sensitive environments on earth – from rain forests and deserts to thousands of feet below sea level.Noble Offshore is involved in all aspects of the production, transportation and processing of oil and gas; from reservoir to market, and are amongst the first to become active in exciting new technologies as they develop from sub sea production to floating LNG plants and FPSOs.

Analysis & Engineering Consulting

Noble Offshore’s client base encompasses oil companies, contractors, shipyards, consultants, designers and utility companies. Our experience across the marine and energy industries provides a unique insight into a range of practices enabling us to advise our clients.

Our consulting capability is driven by our highly qualified staff and recognised industry specialists in a wide range of disciplines including:

Naval Architects

Master Mariners

Marine Engineers

Structural Engineers

Geo technical Engineers

Metocean Engineers

Civil & Mechanical Engineers

Electrical & Automation Engineers

Material Scientists

Occupational Psychologists

Mathematicians & Physicists

Software Designers and Analysts

Jack-up site assessment

Analysis of the ability of a jack-up unit to operate safely at a location within one of the internationally recognized codes of practice is provided quickly and accurately using our specialist software JUSTAS. This unique software is used by the world’s premier drilling contractors to perform a combination of hydrodynamic, structural and foundation response analyses necessary for swift decision- making regarding the capability of any jack-up to operate at its intended location. In addition Noble Offshore helps clients to understand and resolve complex structural and mechanical engineering problems which require not only analytical ability but also an understanding of the marine and operational procedures that govern the safe use of jack-up platforms. Our in-house archive contains current and historical drawings, specifications and operating manuals for most of the jack-up designs currently in use around the world. This enables us to quickly prepare bespoke models for clients to accurate site-specific assessments using the latest international codes of practice.